If you’re looking to improve your overall financial health, creating and sticking to a budget may be one of the most important steps you take. However, getting started can be overwhelming. Even when you have a budget in place, it may be difficult to follow it. Read on to learn how you can create a budget that you can actually follow.

Understanding the Basics: What is a Budget?

A budget is a system that helps you manage your expenses. When you create a budget, you take a look at your income and expenses and decide how much money you will allocate to certain spending categories. A budget can help set you up to achieve your financial goals– whether that’s paying down debt or saving for retirement.

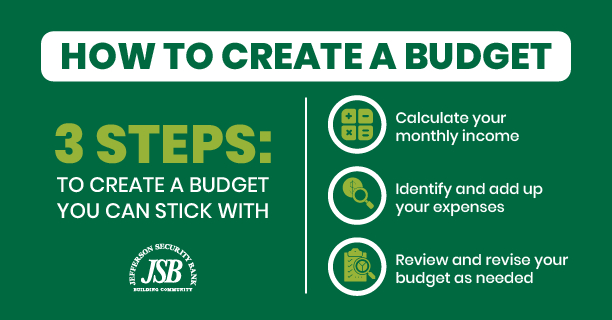

Kickstarting Your Financial Journey: The First Step in Creating a Budget

The first step in creating a budget is to calculate your income and expenses. If you're creating a monthly budget, divide your yearly income by 12. Include all sources of income. Once you know your total income, list out all of your expenses. You should also make a note of which expenses are fixed vs. variable and needs vs. wants.

- Fixed expenses: Do not vary from month-month. Your mortgage is an example of a fixed expense.

- Variable expenses: Can vary each month. Examples of variable expenses include groceries, transportation, entertainment, clothing, and gifts.

- Needs: Necessary expenses. Housing and food are examples of necessary expenses.

- Wants: Expenses that you can live without. Examples of “wants” include dining out, and entertainment related such as streaming services.

Total your monthly expenses. If they exceed your income, you will likely need to cut down on some of your wants. Once you have an understanding of how much money is coming in, and where it is going, it is time to determine your budgeting method.

Choosing the Right Budgeting Method for You: A Comprehensive Guide

There is no right answer for everyone. Oftentimes, people have trouble sticking to a budget because the budgeting method is not right for them. To determine which is the right budget for you, you must understand the various budgeting methods. This includes zero-based budgeting, the 50/30/20 rule, The 60% solution, reverse budgeting, and cash only budgeting.

Zero-Based Budgeting: A Strategy for Every Dollar

With zero-based budgeting, your income minus your expenses is zero. Every dollar is accounted for. This doesn’t necessarily mean that you spend every dollar that you make. Make savings part of your expenses. If you have debt, you should also include that in your expenses. If you have trouble allocating money to savings, the 50/30/20 rule might be a better fit for you.

Mastering the 50/30/20 Rule: A Balanced Approach to Budgeting

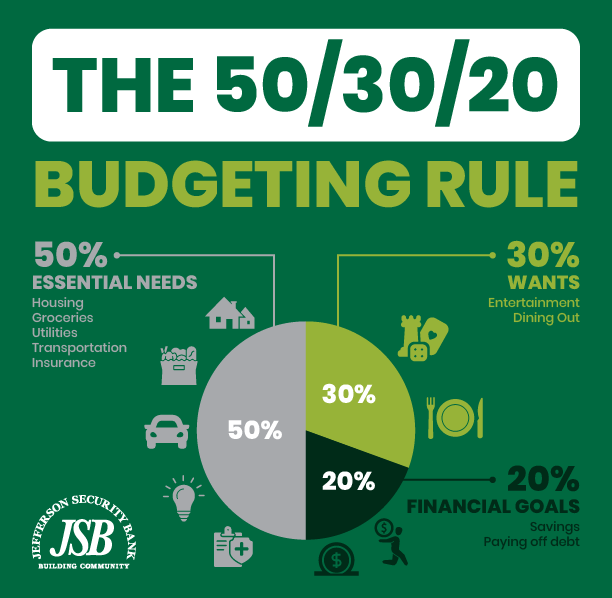

The 50/30/20 rule was made popular by the 2006 book All Your Worth: The Ultimate Lifetime Money Plan. It is often referenced by David Ramsey. This popular budgeting technique suggests you put 50% of your income towards your needs, (necessary expenses) 30% towards your wants, and the remaining 20% towards your savings.

If you have a large amount of debt that you need to pay off, you can modify your percentage-based budget and follow the 60/20/20 rule. Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings. Once you’ve been able to pay down your debt, consider revising your budget to put that extra 10% towards savings.

The 60 20 20 Budget Rule: A Unique Budgeting Method for Savings Enthusiasts

The 60/20/20 budget rule is a simple roadmap to manage your money, and it's a particularly useful strategy designed for individuals whose primary goal is to prioritize savings, debt management and work towards their long-term financial aspirations. Picture your income after taxes as a pie that you're going to divide into three parts.

The biggest part, 60% of your pie, is for your essential living costs (including debts). These are things you absolutely need to pay for to keep your life running smoothly. We're talking about your housing (rent or mortgage), food for your meals, important bills like electricity and water, and any costs related to health care. These are the non-negotiables, the ingredients for your day-to-day life. This chunk ensures that your basic needs are met before anything else.

Now, let's move to the next slice. This 20% slice of your income pie is for your future. This is why the 60/20/20 rule is especially good if you're keen to focus on long-term savings. This slice goes directly into your savings account, retirement fund, or maybe even into investments. It's all about planning for big future milestones, like buying a house or a car, or ensuring a comfortable retirement. It also serves as a safety net in case of unexpected expenses. Consistently dedicating a slice of your income to your future means you're always moving towards your financial goals and growing your financial stability over time.

Lastly, the remaining 20% of your pie is the slice of enjoyment. It's meant for things you want but don't necessarily need. Perhaps a fancy dinner now and then, tickets to a concert, a gym membership, or saving up for a holiday. This slice of the pie is all about balance - it allows you to indulge in the present, enjoying the fruits of your labor without jeopardizing your necessary expenses or future savings.

The 60-20-20 rule is not just a simple budgeting tool, but also a financial strategy focusing on long-term saving. It's like a beginner-friendly guide on how to balance the present necessities and pleasures with a secure future. It helps make sure that while you're living for today, you're also preparing for tomorrow.

Reverse Budgeting: Prioritizing Savings in Your Financial Plan

Reverse budgeting is another savings-focused budgeting method. With reverse budgeting, you make savings a priority and contribute to savings and investing before you budget for housing, debt, needs, and wants. This is a great idea if your main goal is to build a savings account, but not ideal for someone who needs to tackle debt.

Cash Only Budgeting: A Practical Approach to Avoid Overspending

The “cash only” budget is for people who want to avoid the temptation of overspending on their credit cards. With the cash-only budget, it’s recommended that you set up automatic payments for recurring expenses. Use cash for the rest of your expenses. Create envelopes for your spending categories: groceries, transportation, entertainment, etc. Divide the cash up accordingly into each envelope. When the cash from that envelope is gone, you’ve met your budget for that category for the month. You can move cash from envelope to envelope as needed to address shortfalls or changes in plan.

Review and Revise: The Secret to Successful Budgeting

Once you’ve found a budget that will work best for you, it’s time to build your budget. Remember that your expenses cannot be higher than your income. Follow your budget for one to three months and see how well you’ve stuck to it. Review your spending habits and make necessary revisions, whether it’s cutting unnecessary expenses or allocating more towards savings or debt. Make a plan to continuously review and revise your budget on a regular basis, or as your financial situation changes.

My Money Manager: Your Partner in Easy and Stress-free Budgeting

Make budgeting easier with My Monger Manager from JSB. My Money Manager is a free online tool designed to take the stress out of creating and sticking to a budget. JSB online banking customers can use Money Manager to:

- Track spending on various categories, such as entertainment, dining, utilities, education, and more.

- Set up monthly allowances for each spending category and get notifications when you have reached your limit for those categories.

- Set goals such as paying off a loan or saving for a house.

- Manage your overall cash flow.

- Get a snapshot of your net worth by importing other savings accounts, retirement accounts and loans.

To start creating a budget with My Money Manager, enroll in online banking today. If you don’t already have an account with JSB, open a checking account or a savings account online today. You can also visit us at your nearest branch. We have convenient locations throughout West Virginia: Shepherdstown, Martinsburg, Charles Town, and Inwood, as well as Sharpsburg, Maryland.